Modernise your lending business.

Embrace the new frontier of loan application management with FoxHub.

Spend less time on spreadsheets and more time developing your business with FoxHub’s 360 degree one stop solution. Starting up or looking to expand, FoxHub comes with all the tools to connect and manage your business with rapid results using streamlined workflows in the latest cloud-based technology platform.

Key benefits

Grow your business

FoxHub is the very latest in Fintech software providing a fully scalable end-to-end solution for managing all aspects of a loan journey. The core loan management platform capability is further expanded with a built in CRM, Portal and Accounts module, that combine to drive your lending business.

Reduce workflow

Enhanced loan management

Increase confidence

Connect brokers and investors

Accelerate growth

Offer more products

Mitigate risk

Comprehensive audit trail and reports

Grow loan book

FoxHub ease of use

Scalable for business growth

Full line of sight to all transactions

Auto error correction and task prompts

Easy product creation and second charge lending

Increase business productivity and connectivity

Improved loan management workflow

- LAMS allows comprehensive management of a loan application from initial submission to redemption

- Quickly generate or modify products to offer brokers/borrowers

- Second charge lending can be setup and offered quickly

- Full line of sight to all accounts transactions, reducing premature taxation payments

- Missed payments are tracked and lender alerted to allow fast remedial action

- Reduced application hold up with progress auto-prompts and prompted approval stages

- Pre-built and customised email templates can be used within the softwares own mail merge

- Missed payments are tracked and lender alerted to allow fast remedial action

- All communication is logged and files can be uploaded for case archives

Increased productivity

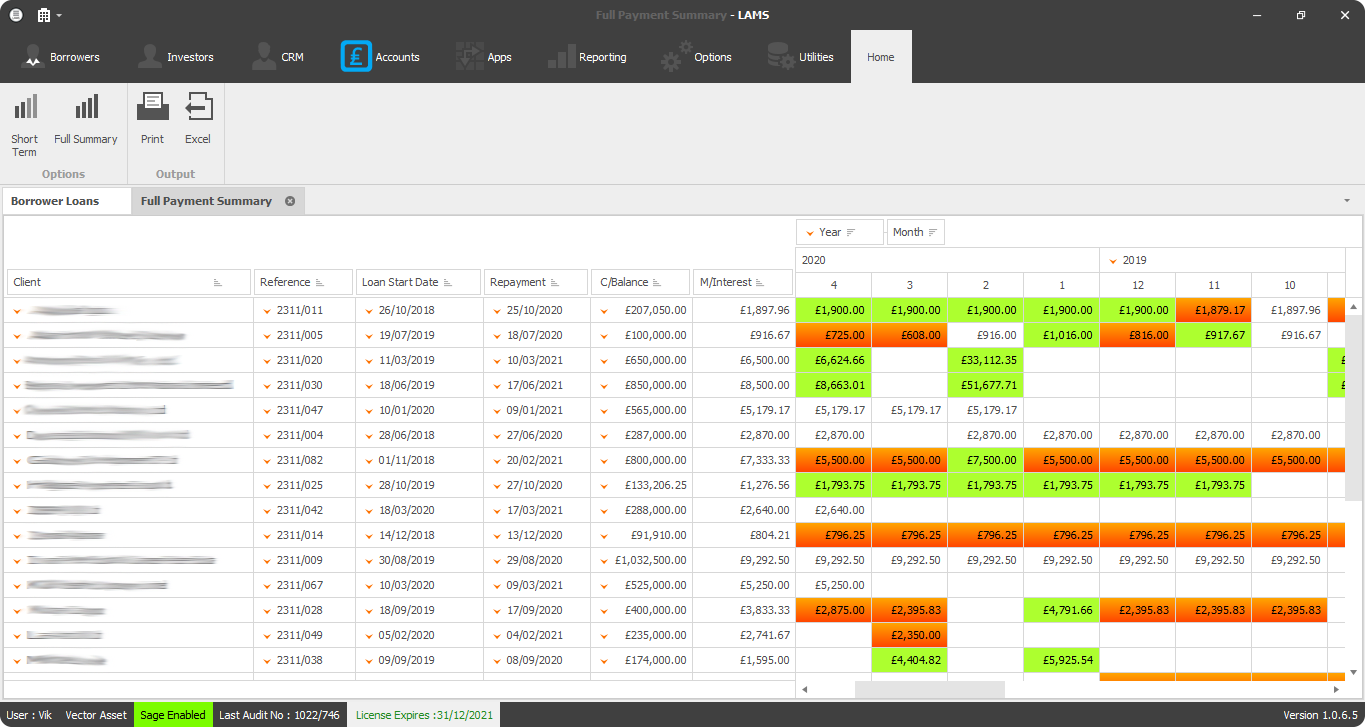

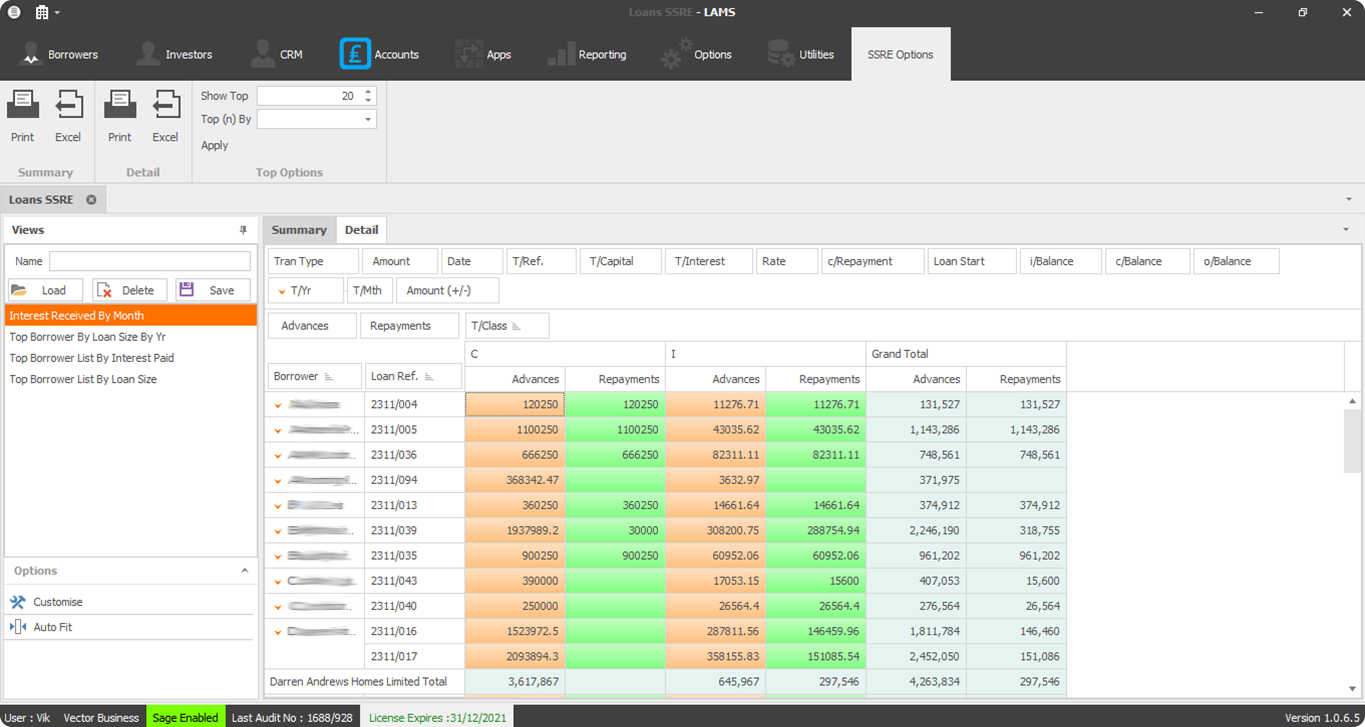

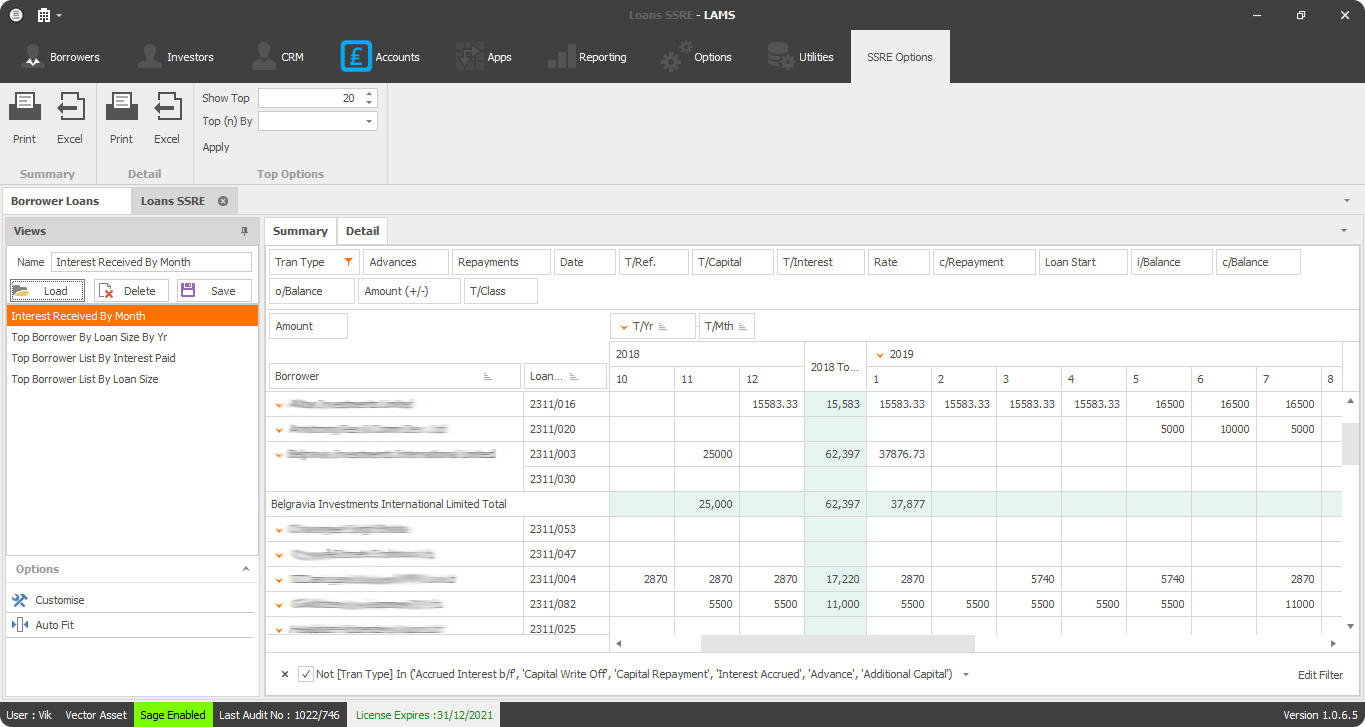

- Bespoke full reporting saves hours in reconciling

- All stakeholders (broker, clients, investors solicitors, against and networks) can be logged in to the system with line of sight to progress of each loan, including general updates, communication history and tasks completed.

- LAMS integration with accounting software provides the ability to defer postings

- Error correction is built in on related accounting entries, increase efficiency

Technology features

- LAMS is a cloud base computing software that ensures all loan management data is safe and more efficiently processed than traditional computer based software

- LAMS uses UK based cloud servers for extra security

- Cloud base technology provides seamless data backups and service updates

- Security features includes failover safeguards and 99.99% SLA

- LAMS integrates easily with SAGE and other accounting packages via API

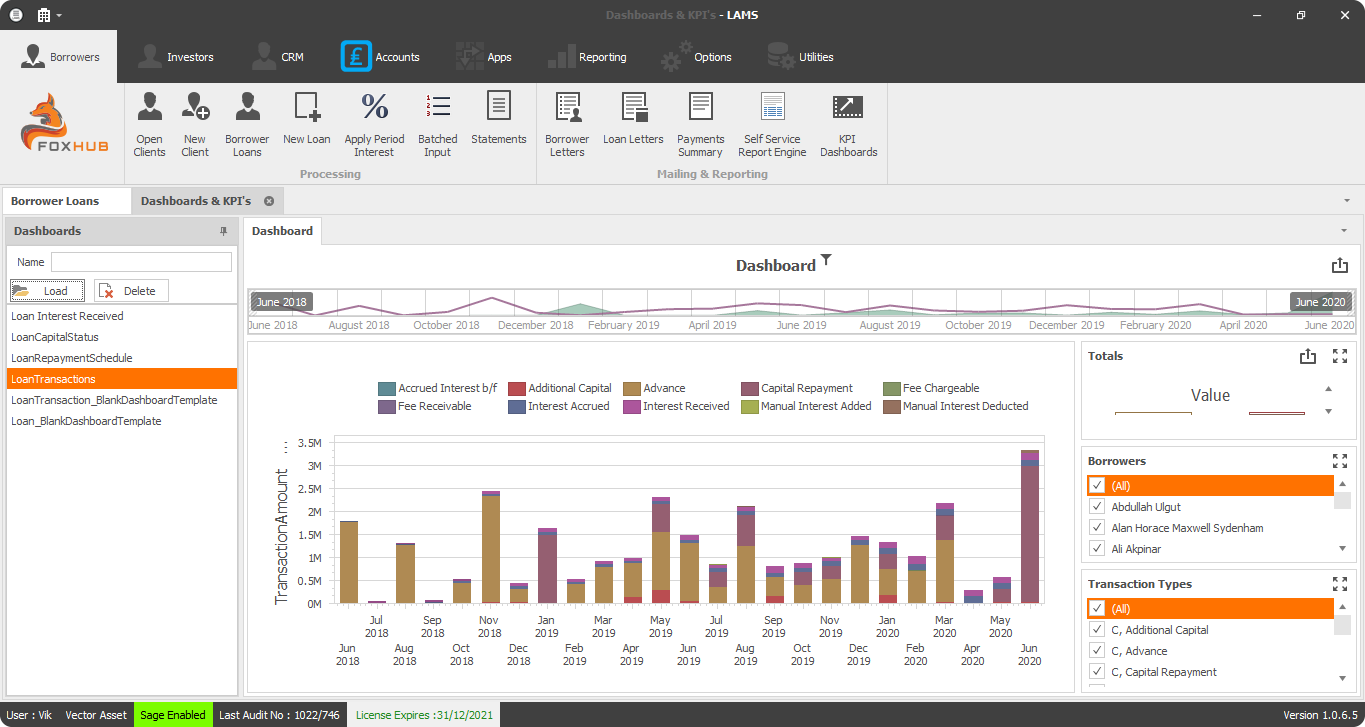

- Intuitive and configurable software interface, including broker and borrower dashboard

- Quick install and setup within - 24hrs

- CRM built in as a module

- Broker portal built in as a module

- Extra data security is provided

Licencing

- One-time low cost install and setup

- For LAMS, a business only needs to pay for one LAMS software access and then separate licences. This provides an accessible implementation of loan application management software in low-mid size businesses.

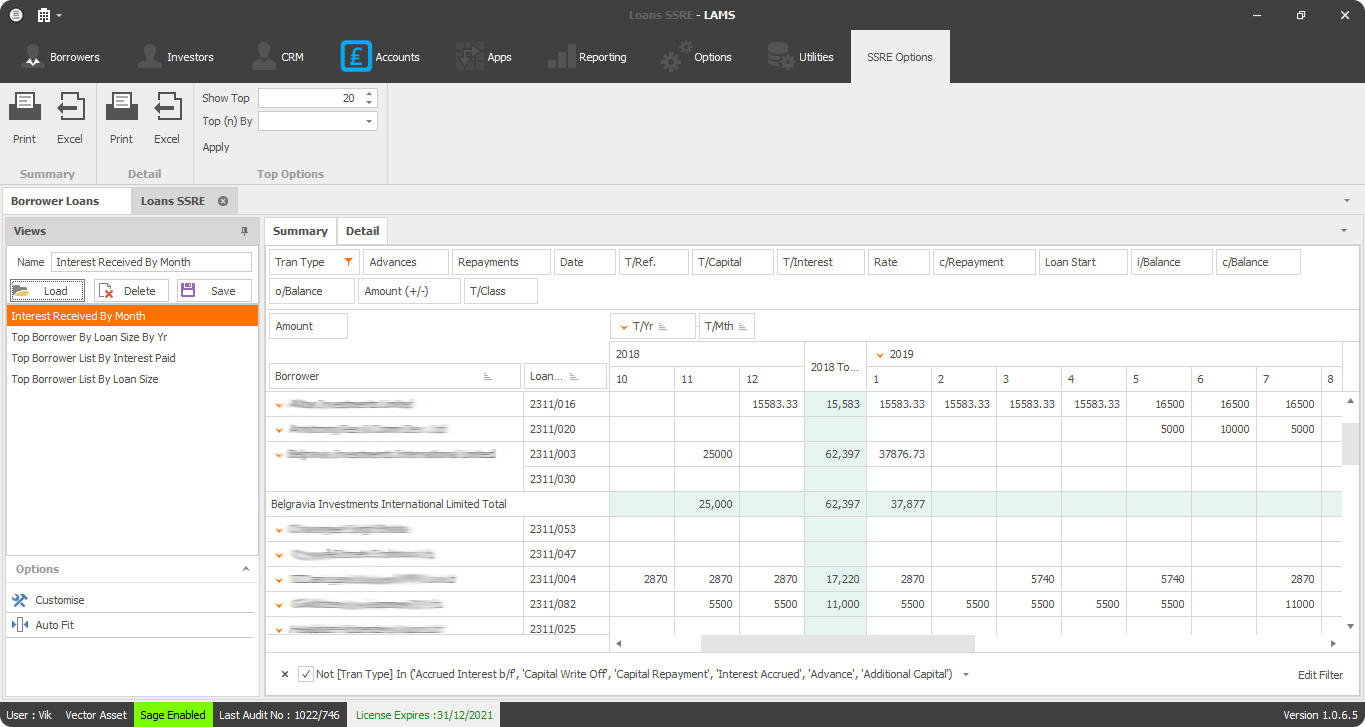

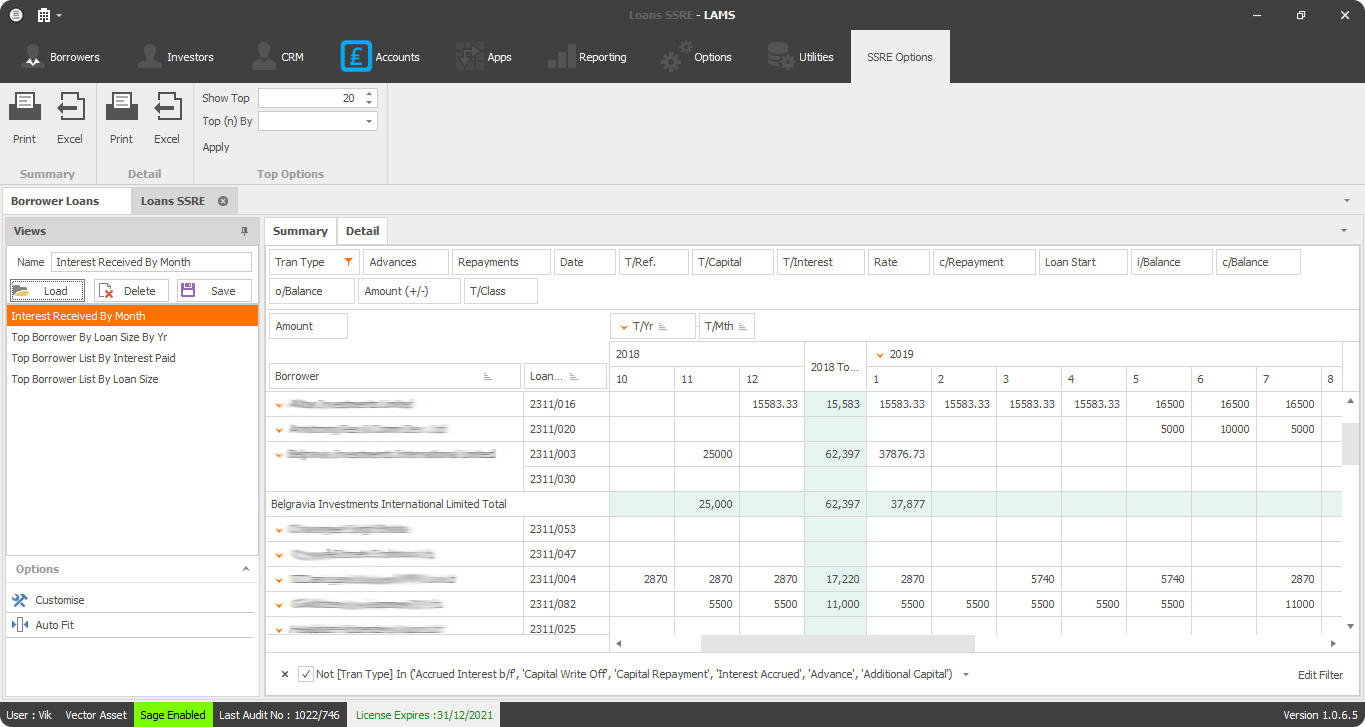

Reporting

- Advanced reporting tool for custom reports

- Generate full auditing reports with ease

How It Works

FoxHub is made up of three key modules

FoxHub LAMS

The FoxHub LAMS module is the core module for the loan application management software that comprehensively controls a loan from initial submission to redemption.

Highlights

- Multiple company connectivity for all broker, client and investor interactions

- Database of all loans with full details

- Advanced loan calculation and error correction tools

- Fast data entry of all loan transactions (with auto posting to Sage 50) or API integration to various accounting systems such as Sage and Xero

- Tracking of missed payments for fast remedial action

- Advancing reporting, including user-designed reports

- Statement generation - anticipated (e.g. for redemption) and actual statements

- Mail-merge letters

- Attachment of documents to the record

FoxHub CRM

The FoxHub CRM is a module specially developed to provide a full overview and management of each customer account, accessible by the lender and all of their stakeholders.

Highlights

- Database management of all Borrowers / Investors / Contacts

- Leads Management - includes: Followup prompts Diary entries Communication sequence templates

- Insights and analytics

- Team communication

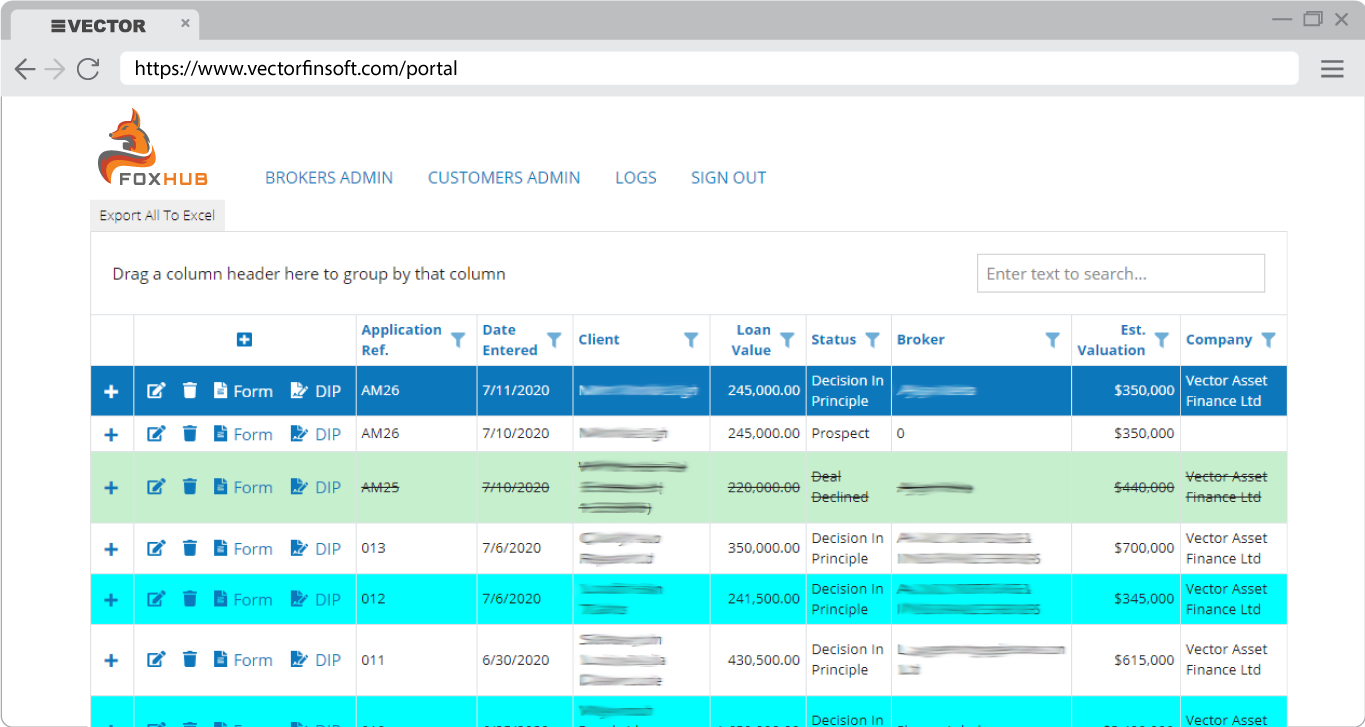

FoxHub Portal

The FoxHub Portal module is built for brokers, investors and clients to connect to the lender and access to FoxHub’s tools.

Highlights

- Remote access that can be read only for brokers, investors, auditors and clients

- Brokers able to submit and monitor all of their cases

- Clients can track loans and monthly statements

- Auditors and Investors can have read only access to pertinent data in real-time

- Audit trails for regulatory compliance

- Support to adhere to FCA

FoxHub Accounts

The FoxHub Accounts module provides full integration from FoxHub to the business finances, providing an end-to-end 360 degree view of all transactions in real time. 3rd party API integration is also possible. Eg. SAGE.