Loan application management has never been made easier.

The FoxHub LAMS module is the core module for the loan application management software that comprehensively controls a loan from initial submission to redemption.

Quick Overview

FoxHub LAMS provides functionally rich workflow management for corporate loan origination – integrated seamlessly into the end-to-end lending process.

Developed for businesses like yours.

The process of managing a loan application can often be made complex requiring a number of approval steps and transactional oversight. Burdened further with inadequate software or manual processes, can often make it more difficult to comply with internal policies and FCA regulatory requirements. Lenders can be quickly consumed by the complexity of the process and are unable to spend time in growing their business.

FoxHub LAMS has been developed for such businesses, empowering lenders to be competitive and more efficient in a fast-paced industry. It not only meets today’s borrower demands for a range of loan products and fast application approval, but also the demands of brokers and investors in having the latest technological assisted workflow.

Using a secure cloud service to provide real-time synchronous data, and an intuitive interface, the software reduces the overall complexity and drives the business, whilst mitigating exposure with powerful auto error prompts and reporting.

Businesses also have the ability to spend time developing their product offering with easily created and modified products and setting up second charge mortgages.

Flexibility is key to the software, from its ability to include multiple company connectivity to broker, client and investor, to its scalability to work with additional modules to make it a complete one-stop shop.

Reduce workflow

Enhanced loan

management

Increase confidence

Connect brokers and

investors

Accelerate growth

Offer more products

Mitigate risk

Comprehensive audit trail

and reports

Grow loan book

FoxHub ease of use

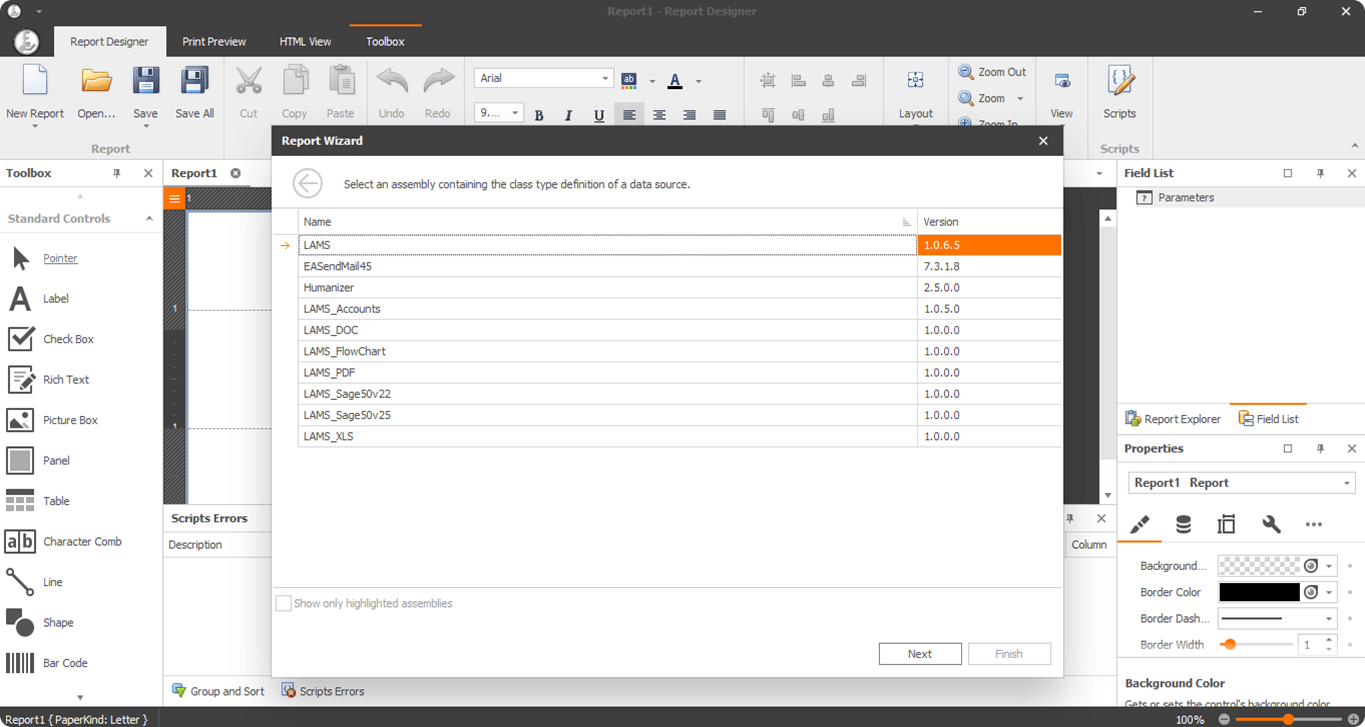

LAMS Report Wizard

Room to grow

Simplify with workflows

Speed up approvals

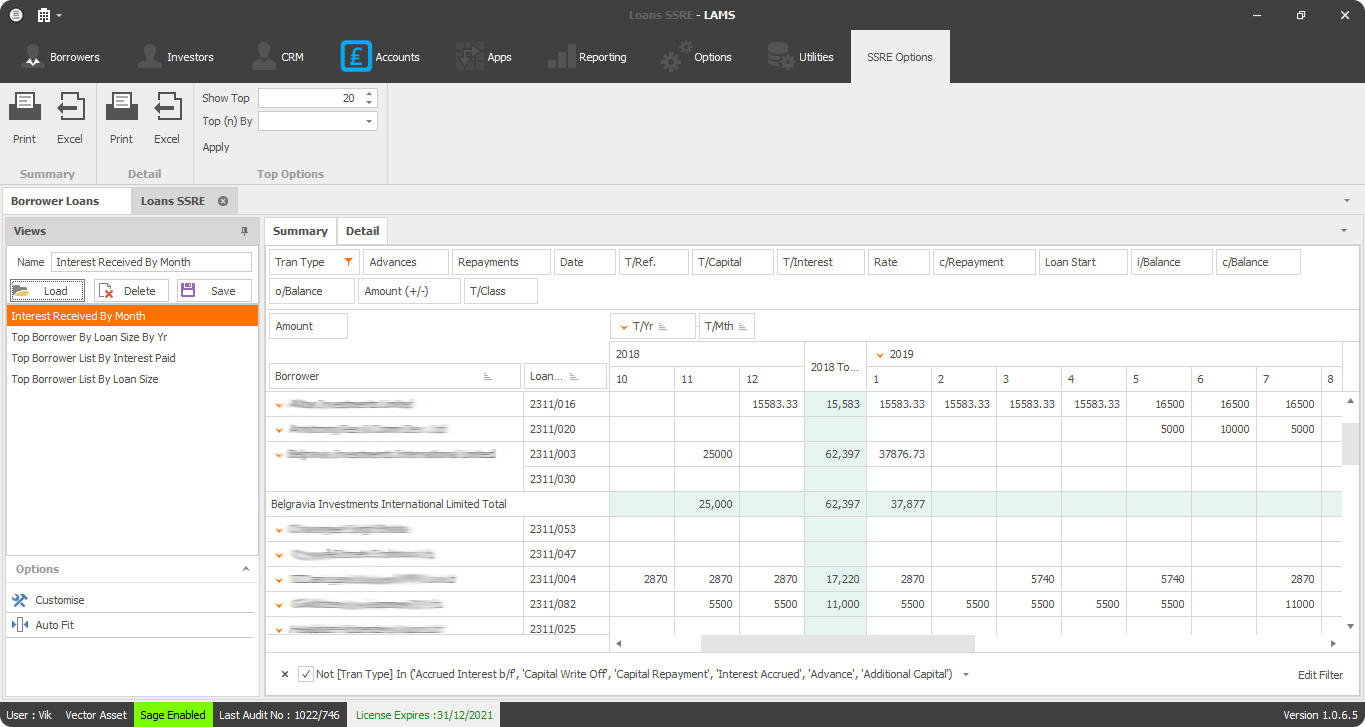

Self Service Reporting

Key benefits

- Real-time cloud service synchronous data to all stakeholders

- Increased productivity with enhanced workflow

- Opportunity to create or modify products

- Scalable users

- Integrates seamlessly with FoxHub CRM, FoxHub Portal and FoxHub Accounts

- Increase revenue by simplifying complexity and reduce the application process time

- One-time low cost install and setup

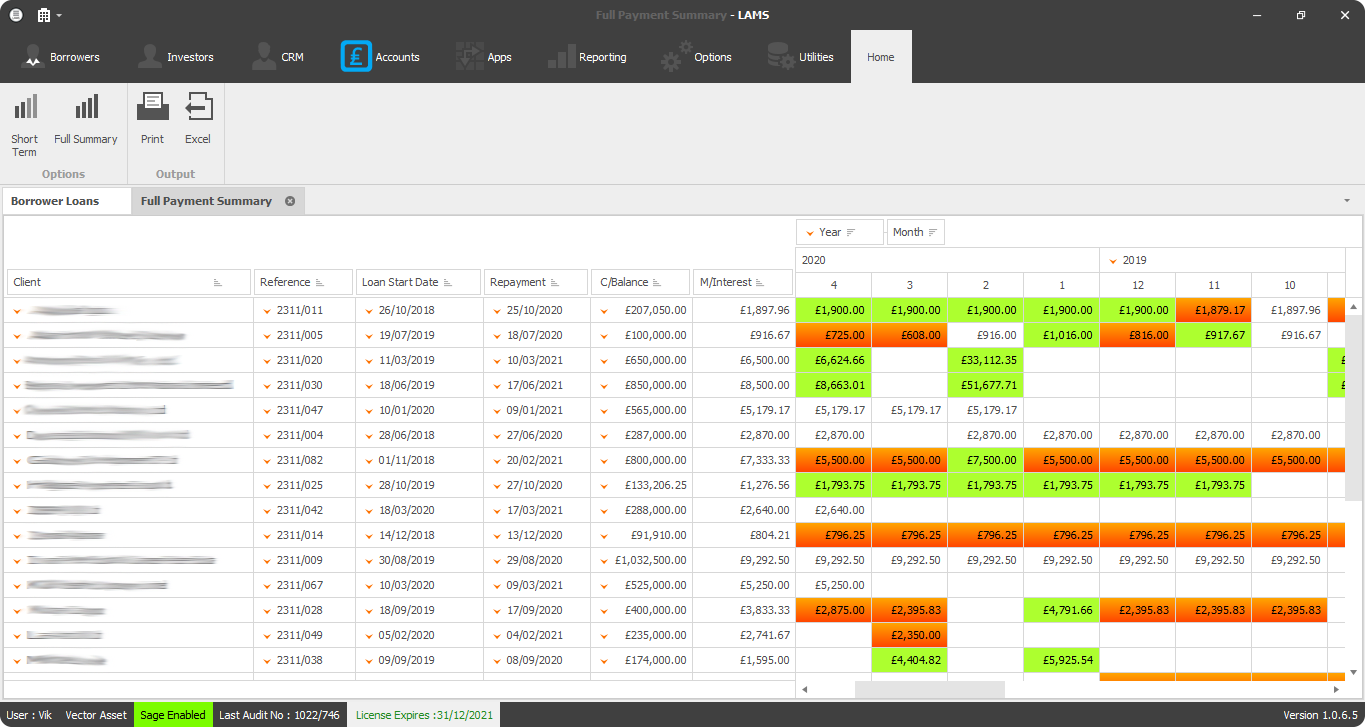

Financial management workflow

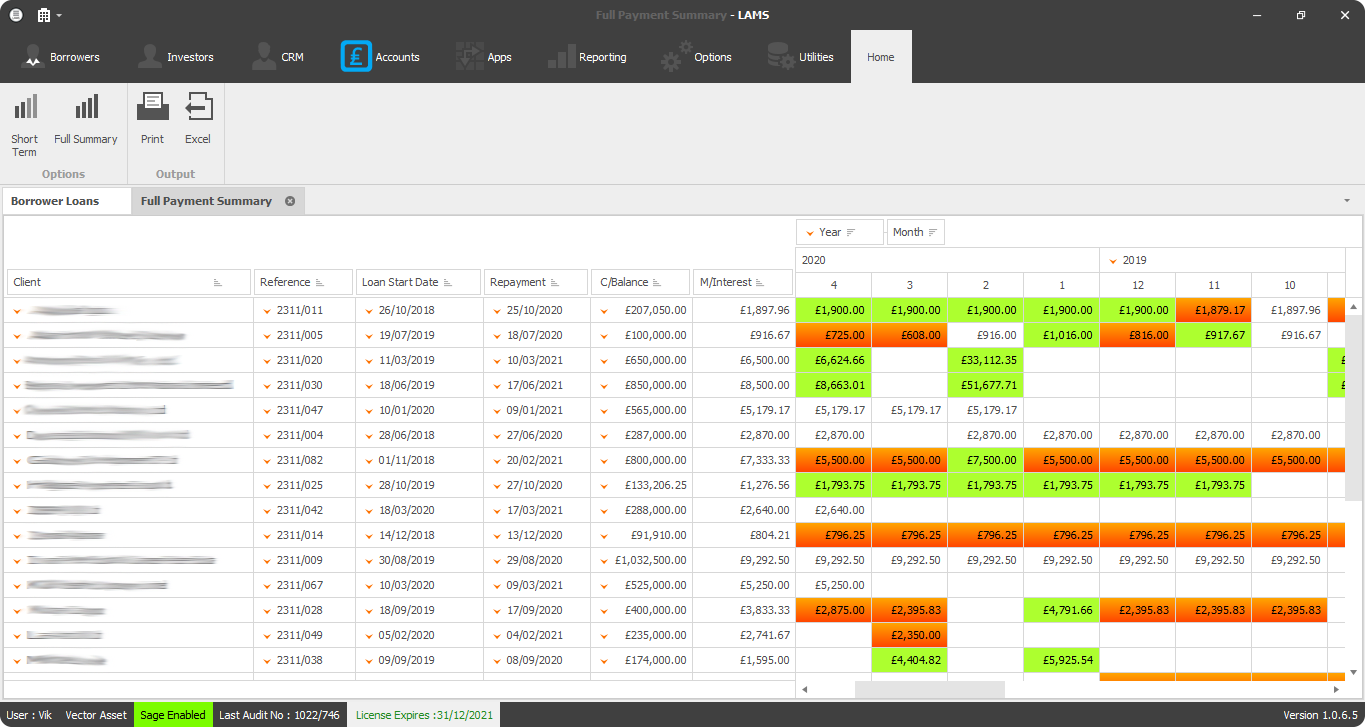

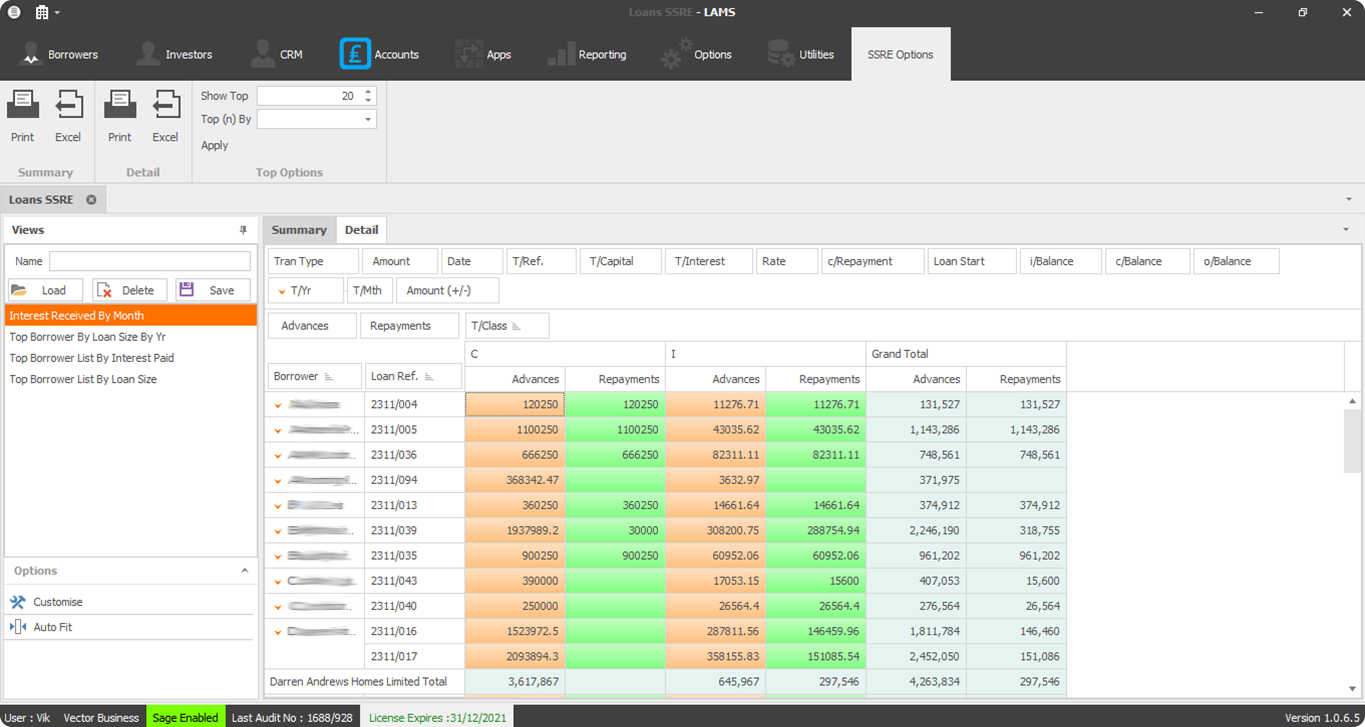

- Bespoke full reporting saves hours in reconciling

- All stakeholders (broker, clients, investors solicitors, against and networks) can be logged in to the system with line of sight to progress of each loan, including general updates, communication history and tasks completed.

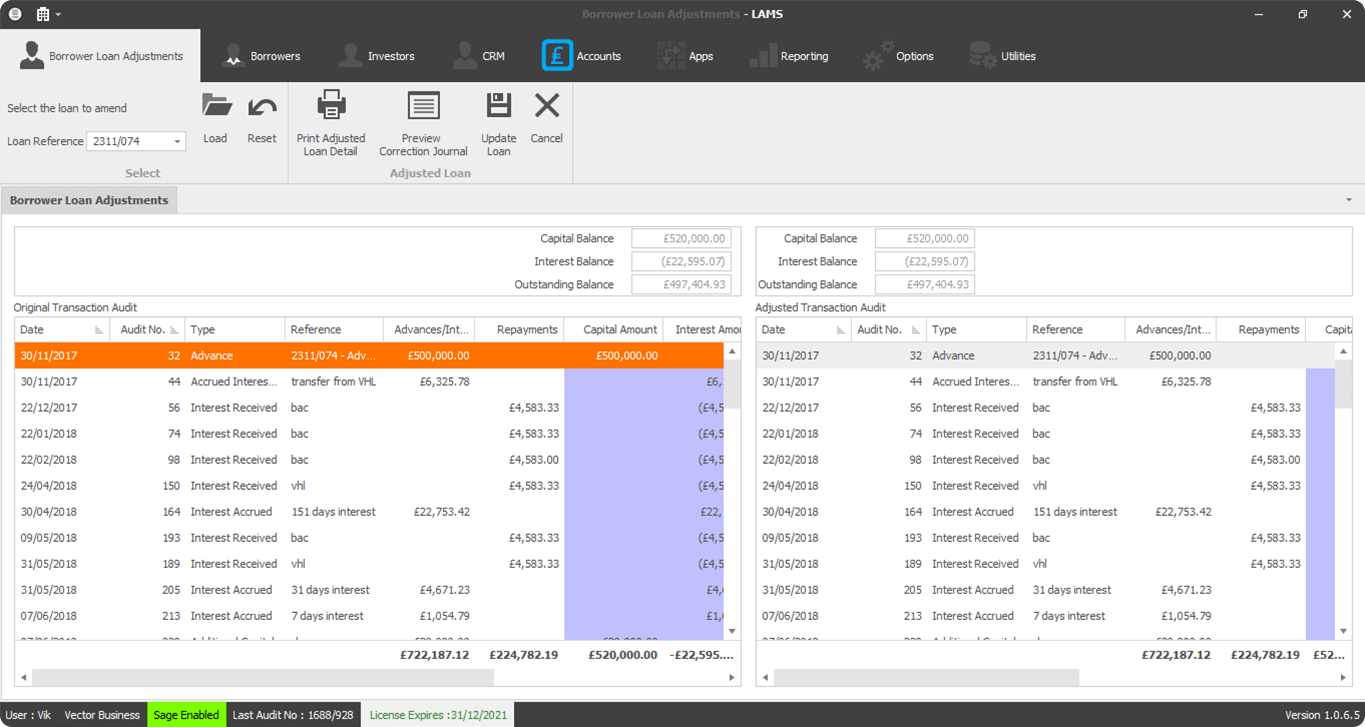

- LAMS integration with accounting software provides the ability to defer postings

- Error correction is built in on related accounting entries, increase efficiency

Technology features

- LAMS is a cloud base computing software that ensures all loan management data is safe and more efficiently processed than traditional computer based software

- LAMS uses UK based cloud servers for extra security

- Cloud base technology provides seamless data backups and service updates

- Security features includes failover safeguards and 99.99% SLA

- LAMS integrates easily with SAGE and other accounting packages via API

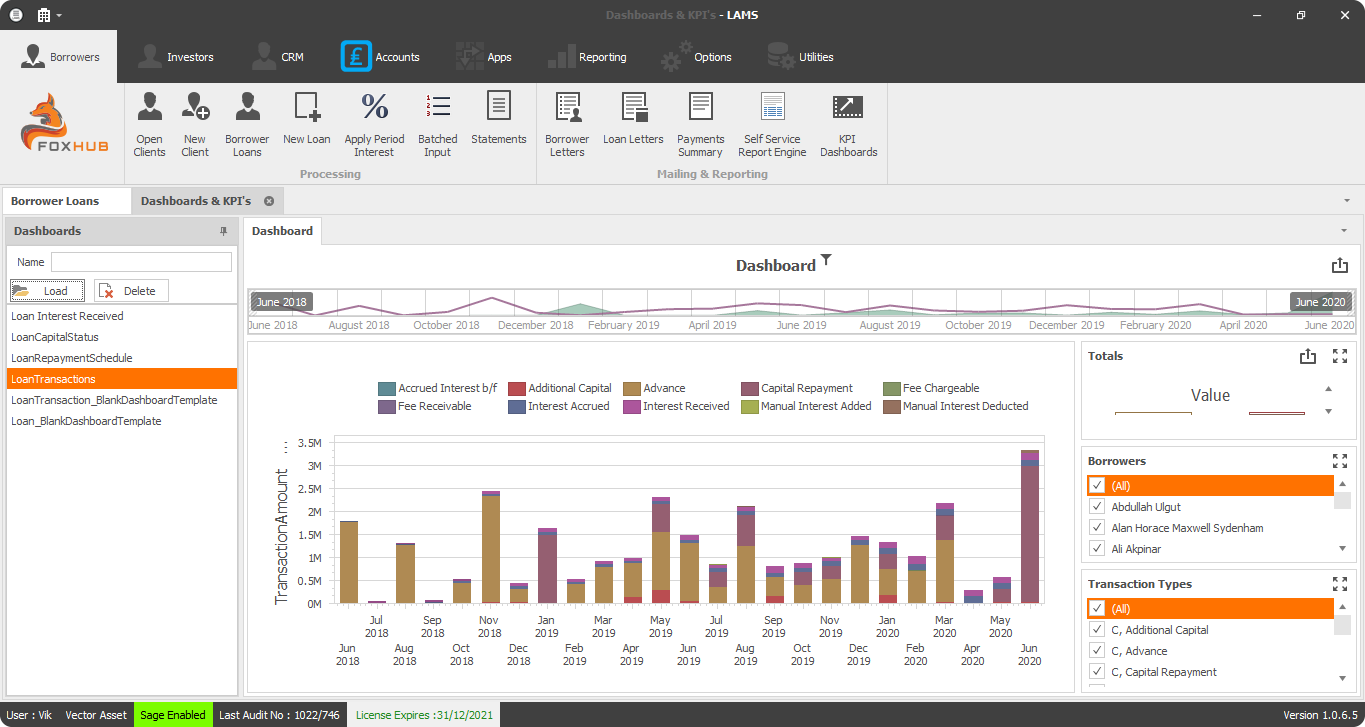

- Intuitive and configurable software interface, including broker and borrower dashboard

- Quick install and setup within - 24hrs

- CRM built in as a module

- Broker portal built in as a module

- Extra data security is provided

Licencing

- One-time low cost install and setup

- For LAMS, a business only needs to pay for one LAMS software access and then separate licences. This provides an accessible implementation of loan application management software in low-mid size businesses.

Reporting

- Advanced reporting tool for custom reports

- Generate full auditing reports with ease